Easy Guide to Using Robinhood for Smart and Effective Investing in 2025

Easy Guide to Using Robinhood for Smart and Effective Investing in 2025

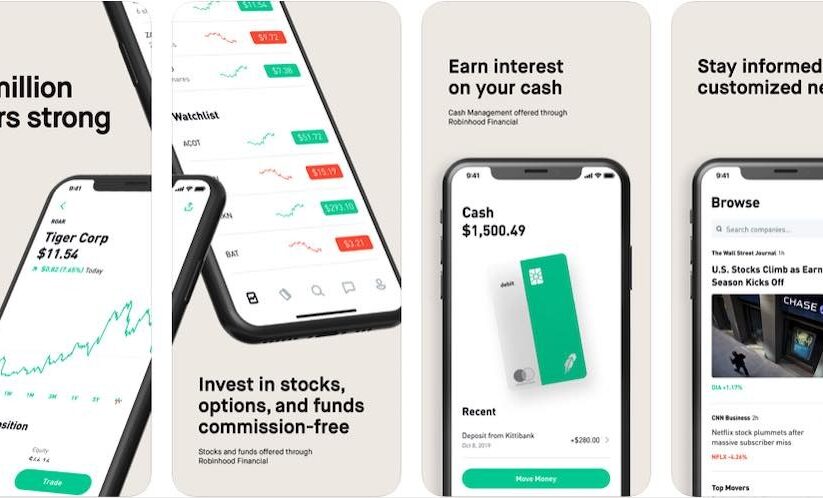

In the world of digital finance, the Robinhood app stands out as a user-friendly platform for investors of all levels. Understanding how to use Robinhood effectively is crucial to maximizing your investment potential in the stock market. This guide will navigate you through the essential features of the Robinhood app, including trading options, account setup, and innovative investment strategies, ensuring you’re well-equipped for smart investing in 2025.

Getting Started: Setting Up Your Robinhood Account

Before diving into investing, it’s essential to understand the steps of robinhood account setup. Downloading the Robinhood app is straightforward; it is available on both iOS and Android platforms. After downloading, signing up for Robinhood requires you to provide some personal information, including your name, email, and social security number for identity verification. Following the robinhood account verification process, you must link a bank account to your Robinhood profile, allowing for seamless deposits and withdrawals.

How to Link Your Bank Account

When using Robinhood, linking your bank account is crucial to fund your investments and execute trades. To do this, access the settings within the app and select “Linked Accounts.” Choose the option to add a new bank account and follow the prompts to enter your banking details. Ensure you have all necessary information, including your account number and routing number. Once linked, you can easily deposit funds to Robinhood to start buying stocks.

Understanding Robinhood’s Account Security Features

Your investment safety is paramount while using the platform. Robinhood incorporates several security measures, including two-factor authentication and bank-level encryptions. Review the security options when setting up robinhood account, and make sure to enable notifications for any account changes. This vigilance helps protect your personal information and investments from potential threats.

Recognizing Robinhood App Features

The Robinhood app offers an array of features that enhance the trading experience. Familiarizing yourself with these robinhood app features can significantly impact your trading strategy and decision-making process. For example, the app’s intuitive interface allows users to easily navigate through stock prices, options, and investment opportunities, ensuring that even beginners can engage with the stock market efficiently.

Exploring Robinhood Research Tools

To make informed decisions, investors must leverage the robinhood research tools available within the app. These tools provide insights into stock performance and historical trends, vital for refining your investment strategies. Users can track stock performance, read company news, and analyze market trends directly on the platform. By using these features, you’re poised to utilize trade execution strategies effectively.

Utilizing Robinhood Alerts and Notifications

Staying updated is crucial in trading. Robinhood allows users to set up personalized alerts for price changes, market news, and upcoming earnings reports. To maximize your portfolio, take advantage of robinhood alerts setup, which can notify you when specific stocks are reaching your desired buy or sell prices. This proactive approach can enhance your investment decisions.

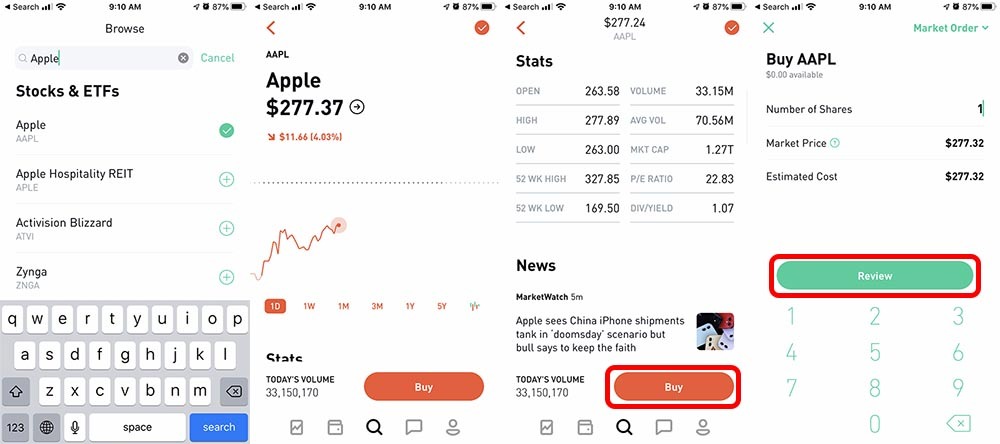

Strategies for Trading on Robinhood

Once your account is set up and you’re familiar with the app’s capabilities, it’s time to explore effective trading strategies for Robinhood users. Knowing the basics of buying and selling on the platform can aid in optimizing your trades and achieving your investment goals.

Understanding Market Orders and Limit Orders

Among the key aspects of trading on Robinhood is understanding the different order types. A market order buys or sells a stock at its current market price, giving you quick access to the stock. In contrast, a limit order allows you to specify a price at which you’re willing to buy or sell, providing greater control over your trades. Knowing when to execute these can greatly influence your trading outcomes and help you avoid common pitfalls.

Day Trading on Robinhood: Cons and Pros

Day trading is a strategy adopted by many active investors on Robinhood. This involves buying and selling stocks within the same trading day to capitalize on short-term market fluctuations. However, it requires a deep understanding of market volatility and a solid grasp of technical analysis. If you’re considering day trading on Robinhood, ensure you’re also aware of the risks involved and develop a sound risk management plan to safeguard your investments.

Best Practices for New Investors

As a beginner looking to enhance your financial literacy and investment acumen, employing best practices can significantly impact your journey. Recognizing the best stocks on Robinhood and diversifying your portfolio are significant aspects of developing strong investment habits.

Portfolio Diversification Strategy

A smart diversification strategy involves spreading your investments across various sectors and asset classes to minimize risk. With Robinhood, you can easily explore investment options to create a balanced portfolio that reflects both risk tolerance and capital availability. Consider investing in ETFs or index funds for broad market exposure, which offers a safer approach compared to focusing solely on individual stocks.

Utilizing Robinhood for Passive Income

Investing in dividend-paying stocks or ETFs can generate passive income streams through robinhood dividends. Monitoring market trends and understanding how to select investments that align with your financial goals will help you make choices that foster long-term wealth. Establishing a sound investment plan now can set you on a path to financial independence in the future.

Key Takeaways

- Get started by properly setting up and securing your robinhood account.

- Familiarize yourself with robinhood’s rich features and research tools.

- Develop informed strategies for trading, including understanding order types and day trading approaches.

- Implement diversification in your portfolio to manage risks effectively.

- Consider investing in dividend stocks for passive income and long-term growth.

FAQ

1. What are robinhood commission-free trades?

Robinhood offers commission-free trades, meaning you can buy and sell stocks without paying standard brokerage fees. This feature significantly benefits new investors, allowing you to manage your investments without worrying about high fees eating into profits.

2. How does one deposit funds in Robinhood?

To deposit funds, navigate to your account settings and select the option to add money. You’ll need to have a linked bank account to transfer funds. Based on Robinhood’s policies, be mindful of the robinhood deposit limits for cash transfers, which may depend on the account type and verification stage.

3. What are the tax implications of trading on Robinhood?

Investors are responsible for any capital gains taxes incurred by trading stocks or options on Robinhood. It’s essential to keep records of your trades and consult with a tax professional to understand the tax implications trading on Robinhood. Effective tax planning can enhance your net gains significantly.

4. Can I use Robinhood for cryptocurrency trading?

Yes, Robinhood allows users to trade various cryptocurrencies. If you’re interested in using Robinhood for cryptocurrency investment, be sure to do thorough research on each crypto asset’s market trends to manage risks accordingly.

5. How can I manage my portfolio effectively on Robinhood?

Regularly monitor your investments through Robinhood’s tracking tools and set goals based on your financial objectives. By employing a portfolio diversification strategy and utilizing the app’s research resources, you can make informed decisions to optimize your investment performance.

6. What are some stock trading tips for beginners on Robinhood?

As a beginner, start small, focusing on stocks you understand. Diversify your investments and utilize Robinhood’s analysis tools to evaluate your holdings. Also, consider following established investors or educators within the Robinhood community for proven stock trading tips and best practices.

7. How can I connect my bank account to Robinhood quickly?

You can connect your bank account by selecting “Linked Accounts” in the app settings. Follow the steps to input your bank details. Ensure the information is accurate to facilitate a smooth connection. It’s advisable to verify the bank account with a small deposit confirmation from Robinhood for added security.