Simple Ways to Endorse a Check Effectively in 2025: Discover Best Practices

Simple Ways to Endorse a Check Effectively in 2025: Discover Best Practices

In the rapidly evolving landscape of finance, understanding how to properly endorse a check has become increasingly important. Whether for personal reasons, business transactions, or digital formats, knowing the right methods of endorsement check will save you time and avoid unnecessary hiccups. In this article, we will guide you through the best practices to endorse a check effectively in 2025, addressing various scenarios and common queries that arise regarding check endorsement.

Understanding the Basics of Check Endorsement

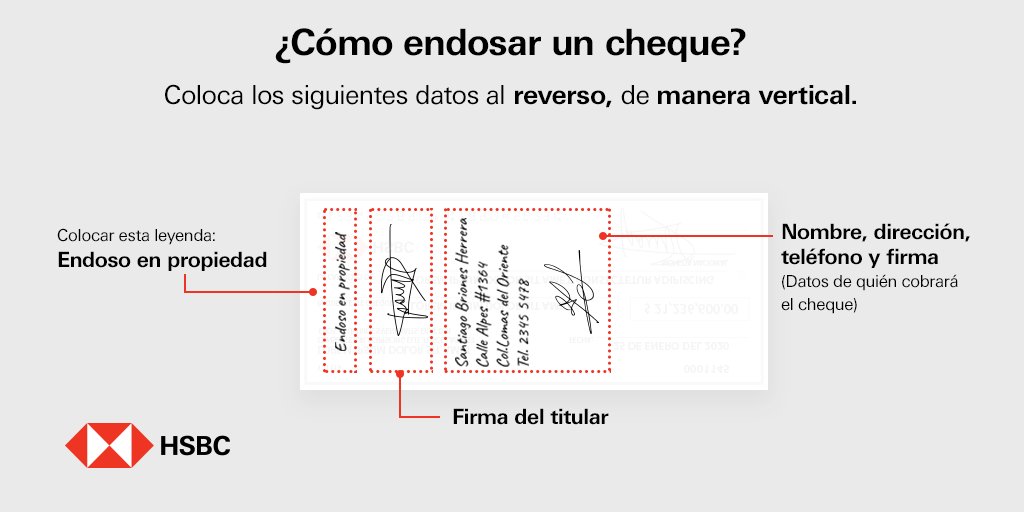

To start, it’s essential to grasp what a check endorsement is. A check endorsement refers to the process of signing the back of a check to authorize it for payment. The requirements to endorse a check can vary, but it typically involves providing your signature and sometimes an account number or additional instructions. Understanding the significance of this process is crucial, as it ensures the check is directed to the right recipient and prevents fraudulent activities.

Types of Check Endorsements

There are several types of check endorsements you should be aware of. The most common include:

- Blank Endorsement: Just your signature. Anyone can cash this check.

- Restrictive Endorsement: Such as “For Deposit Only,” which limits how the check can be used.

- Special Endorsement: Transfers the check to another person. This type might specify “Pay to the order of [Name].”

Understanding these types can help you choose the appropriate method for endorsing a check based on your transaction’s needs. For instance, a restrictive endorsement may be ideal if you want to ensure the funds go directly into your bank account, preventing any unauthorized cashing of the check.

How to Properly Endorse a Check

When learning how to endorse a check, always remember the critical elements to include:

- Your signature exactly as it appears on the front of the check.

- Dated endorsements if required (common with business checks).

- Additional instructions such as “for deposit only” if applicable.

Each of these components ensures that your check endorsement process adheres to check endorsement guidelines dictated by banks and financial institutions.

Endorsing Checks for Various Purposes

Depending on your situation, the method of endorsing a check can change. Below are several common scenarios:

Endorsing a Check for Deposit Only

When you include the phrase “For Deposit Only” in your endorsement, you secure the check in your account specifically. This technique minimizes your risk of theft or fraud. After writing this phrase along with your signature, you can then deposit your check through online banking apps or in-person at ATMs, making the process more straightforward and secure.

How to Endorse a Check When You’re Not the Payee

If you’re endorsing a check on behalf of someone else, the process is slightly different. You need to sign the original payee’s name followed by your signature, indicating your authority to cash or deposit the check. This method of endorsing a check on behalf of someone is especially relevant in corporate settings where checks can be issued to a business but may need to be handled by individual employees.

Secure Methods of Endorsing a Check

In today’s digital age, security is a major concern. Knowing how to endorse a check securely can protect you against fraud.

Mobile Check Endorsement

With advances in technology, one of the most effective ways to endorse a check is through mobile banking apps. Follow these steps:

- Make sure your bank supports mobile check endorsement.

- Sign the back of your check as usual and write any required instructions.

- Take a clear photo of the front and back of the check through the app.

- Submit the images for processing.

This method provides a secure and quick way to handle checks from the comfort of your own home.

Endorsing a Check at an ATM

For those who prefer in-person solutions, many ATMs allow you to endorse a check. Insert your check as prompted and follow the on-screen instructions to complete your endorsement. Useful tips include ensuring there’s no obstruction on the endorsement area to avoid machine errors and keeping your card handy since it often requires account verification.

Common Mistakes and Best Practices for Endorsing Checks

Understanding the end endorsement process is vital. Here are some common mistakes and ways to avoid them:

Endorsement Check Mistakes

Many individuals fail to realize the significance of their signatures matching the print on the front. Any discrepancies might result in the bank refusing to cash or deposit the check. Similarly, omitting the date or instructions on a restrictive endorsement can complicate the process. Staying aware of and adhering to check endorsement requirements ensures a seamless transaction.

Best Practices for Endorsing a Check

When endorsing a check, simple practices can enhance security and efficiency. Always use a pen when signing to prevent alterations, avoid endorsing checks until you are ready to deposit them, and utilize digital options where available to limit the handling of physical checks.

Key Takeaways

- Check endorsements can vary; know the type that suits your needs.

- Security is paramount; consider mobile and ATM endorsements for safety.

- A clear understanding of guidelines and common mistakes will simplify your check endorsement process.

FAQ

1. What are the requirements to endorse a check securely?

To endorse a check securely, ensure your signature is written clearly, include instructions such as “For Deposit Only,” and avoid endorsing the check until you’re prepared to deposit it. These measures reduce the risk of theft or fraud.

2. Can I endorse a check without a bank account?

Yes, you can endorse a check without a bank account at certain check-cashing locations or stores, but they often charge a fee for the service. Ensure you bring a valid ID to facilitate the process.

3. How can I endorse a check for someone else?

You can endorse a check for someone else by signing their name first and then writing your name underneath as an authorized agent. Make sure this is permissible; some checks stipulate restrictions against endorsements.

4. What is the best way to endorse a check as a business?

A business commonly endorses checks by using a stamp that standardizes the process, ensuring clear visibility and professionalism. Employees should endorse checks in compliance with company policies.

5. What technology is available for endorsing checks?

Many banks offer mobile check endorsement through their banking apps, allowing users to capture images of checks for electronic deposits. This method not only streamlines the endorsement process but also enhances security in the handling of physical checks.

6. What should I do if I mistakenly endorse a check incorrectly?

If you realize you’ve endorsed a check incorrectly, do not attempt to use it. Contact your bank immediately for guidance on the next steps, as they may require the check to be redone to ensure security.

7. How to endorse a payroll check?

When endorsing a payroll check, sign the back as accurately as possible matching the name on the front. If you wish to deposit it directly, consider writing “For Deposit Only” along with your signature to secure it for your bank account.

By following these practices in 2025 and beyond, you can navigate the check endorsement process with confidence, prioritizing security and efficiency in each transaction.