How to Properly Endorse a Check for Smooth Transactions in 2025

“`html

How to Properly Endorse a Check for Smooth Transactions in 2025

Endorsing a check properly is crucial for ensuring seamless transactions. Whether you are cashing a check at a bank or transferring it to another party, understanding the endorsement process is essential for avoiding delays and complications. In 2025, knowing the right techniques and responsibilities involved in check endorsements becomes more vital than ever. This article will guide you through everything you need to know about how to endorse a check effectively.

Understanding Endorsements: Definitions and Requirements

To effectively endorse a check, it is important first to grasp its definitions and requirements. In finance, an endorsement refers to a signature or statement on the back of the check which authorizes the check to be cashed or transferred. The endorsement requirements often entail including the signature of the payee and may require additional information depending on the banking institution. For business transactions, adhering to endorsement standards is not just a formality; it prevents legal disputes and ensures compliance with financial regulations.

Types of Check Endorsements

There are several types of check endorsements you should be familiar with. The most common types include blank, restrictive, and special endorsements. A blank endorsement is simply your signature, which allows the check to be transferred easily. A restrictive endorsement limits how the check can be cashed, often by adding “For Deposit Only” along with your account number. Understanding these types will help you identify which to use based on your financial situation and the endorsement verification process of your bank.

Legal Considerations in Endorsements

Legal endorsement can significantly impact financial transactions. It’s important to know the endorsement legitimacy of the transaction, especially in dealings that involve large sums or significant transactions. The legal standing of endorsements can prevent fraud and ensure that parties involved are protected. Always consult legal documentation and guidelines to affirm the legitimacy of the check and comply with financial regulations.

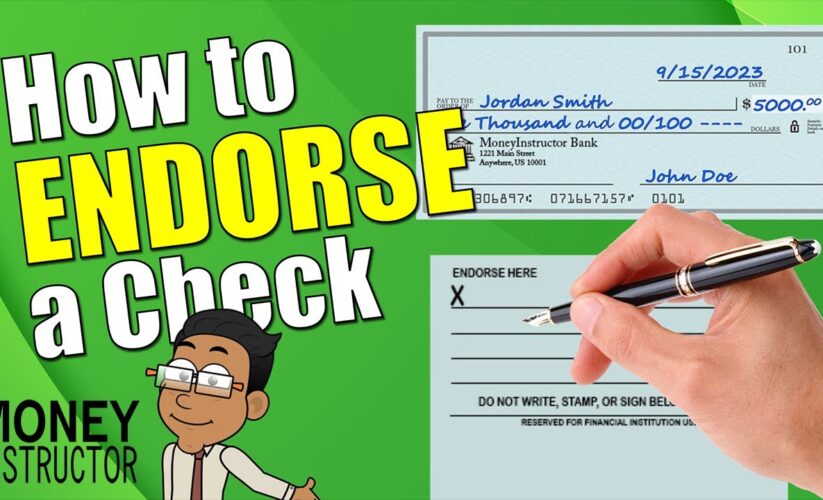

Practical Steps for Endorsing a Check

A smooth endorsement starts with the right procedures. Here’s a step-by-step guide on how to properly endorse a check:

- Verify the Check: Examine the check for any discrepancies or missing information, ensuring the endorsement verification process is initiated.

- Sign on the Back: With a reliable pen, sign your name on the endorsement line. Make sure it matches the name on the front of the check to avoid any endorsement compliance issues.

- Add Instructions: If necessary, incorporate instructions like “For Deposit Only” or transfer details should you be passing the check on to another party.

- Submit to the Bank: Finally, present the endorsed check to the bank. Ensure you have valid identification to support your endorsement approval.

Common Mistakes to Avoid When Endorsing a Check

While the process seems straightforward, many make mistakes that can result in delayed transactions. Some common pitfalls include endorsing the check too early, not matching signatures, or failing to add necessary instructions. Each of these mistakes could slow down the transaction or even lead to returned checks, which can affect your financial obligations and endorsement ratings in the future. Always double-check the endorsement area before submission!

Endorsements and Tracking for Enhanced Security

In today’s digital age, tracking endorsements has become an essential part of maintaining transaction integrity. Many banks have incorporated endorsement tracking systems to monitor endorsements and quickly address any anomalies. Leveraging technology ensures that both endorsed parties are protected and provides further verification in case of disputes or audits. Keeping a record of endorsements through financial software or apps also assists in confirming legitimacy and compliance with established endorsement guidelines.

Benefits of Properly Endorsing Checks

Understanding the benefits of endorsement practices can significantly improve your transaction experience. Properly endorsing checks not only expedites the cashing or transferring process but also prevents fraud and ensures legal protection for all endorsed parties involved. Building a reputation for following robust endorsement procedures boosts trustworthiness in business dealings and ensures adherence to financial regulations.

Enhanced Security in Endorsing Transactions

Endorse follow-ups help enhance security in financial transactions. Establishing a follow-up system with banks or endorsers can serve as a thorough verification method for endorsed checks, vastly limiting fraud. It creates a transparent flow of information that upholds the integrity of endorsed transactions, significantly improving financial compliance across the board.

Case Study: Successful Endorsements in Business

Consider a small business owner who relies heavily on checks for client payments. By implementing thorough endorsement practices, this owner significantly reduced instances of returned or fraudulent checks. Training employees on endorsement techniques and constantly reviewing endorsement policies harnessed a culture of compliance and proactive financial management. This direct application of endorsement knowledge not only improved cash flow but also fostered valuable client relationships.

Conclusion and Summary

Mastering the art of properly endorsing a check is pivotal for seamless financial transactions in 2025. Understanding the different endorsement types, legal ramifications, and common practices elevates your financial management skills. Following the outlined steps and avoiding typical pitfalls will help reduce complications and enhance transactional integrity. Always remember to stay updated with endorsement requirements, and don’t hesitate to seek assistance or legal advice where necessary.

Key Takeaways

- Understand various types of endorsements and their specific requirements.

- Employ clear steps to follow the endorsement process effectively.

- Utilize endorsement tracking systems to enhance security.

- Avoid common mistakes to ensure timely transactions.

- Regularly review endorsement policies to guarantee compliance.

FAQ

1. What is the meaning of endorsement in financial transactions?

The term “endorsement” refers to a signature or modification made on the back of a check, authorizing its cashing or transfer. Understanding this is crucial for compliant and secure transactions.

2. What are the key benefits of endorsements in business?

Proper endorsements increase transaction security, expedite cash processes, and protect both parties from potential fraud. They build trust and transparency in financial interactions.

3. How do I properly track endorsements?

Tracking endorsements can be streamlined by utilizing digital financial tools or systematic bank checks. This ensures all transactions are verified and accurate, enhancing security.

4. What are the common mistakes people make when endorsing a check?

Common mistakes include signing inconsistently, not adding transfer instructions, and endorsing checks prematurely. Such errors can complicate or delay payment processing.

5. Can I endorse a check to someone else?

Yes, checks can be endorsed to another party by adding your signature followed by “Pay to the order of [Name].” This allows the check to be transferred to another individual or organization.

6. Why is the endorsement verification process important?

Endorsement verification is crucial for ensuring that checks are legit and that the authorized person is cashing or transferring the check, which helps prevent fraud.

7. How does an endorsement affect legal obligations?

An endorsement can establish legal obligations among the parties involved. Understanding endorsement requirements and compliance is vital for minimizing disputes and ensuring lawful transactions.

“`